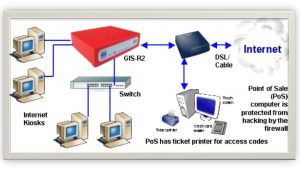

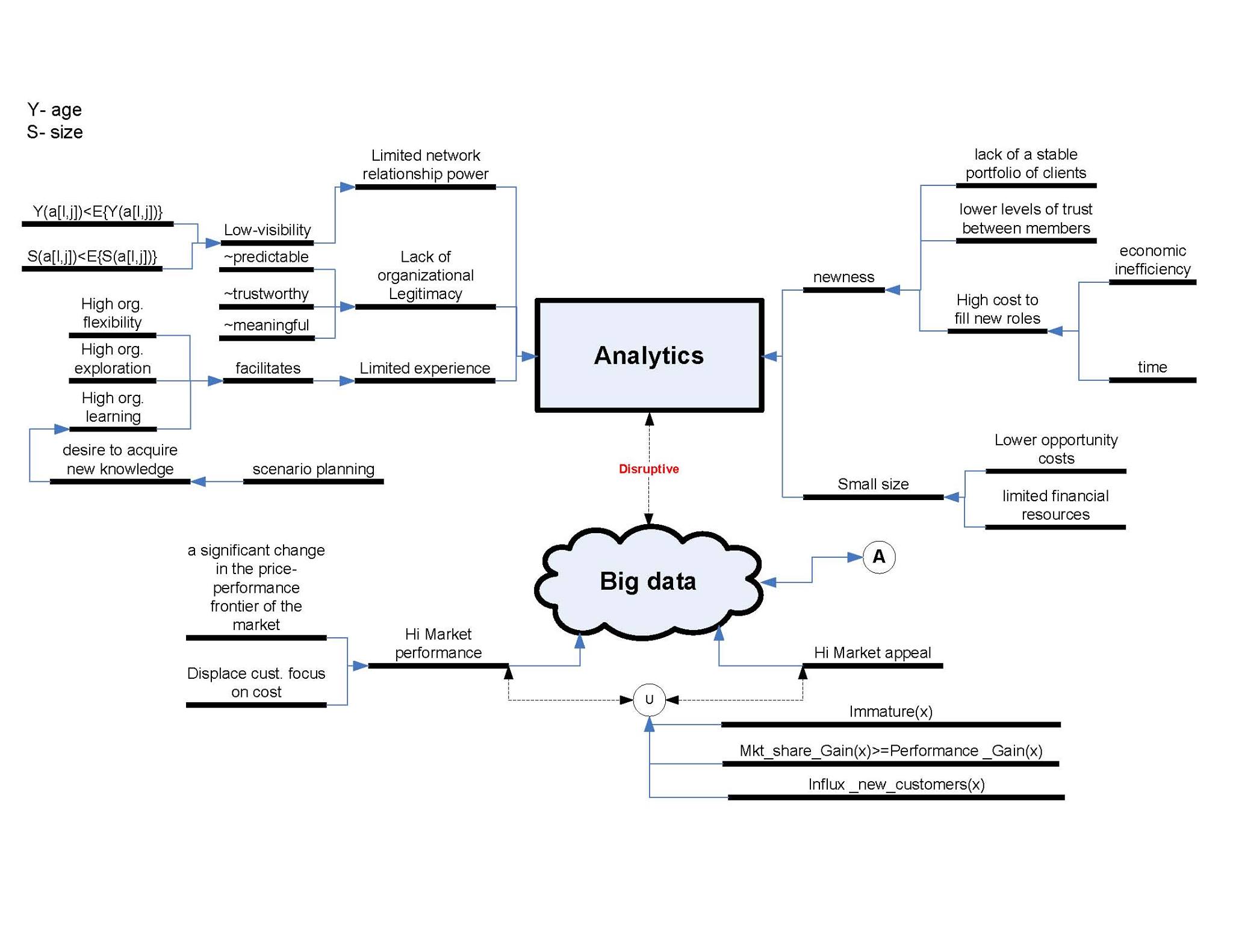

In the last posting or the last scholarship discussion, the historical narrative was based on the 1800s to 1950s real estate periods. In the 1950s to 1960s, collections of real estate listings were stored into 5 inch floppy discs. Verification of loan applicants through collateral, capital, condition, capacity and credit (5Cs) were eventually introduced (Aluya, 2007, 2007a, 2008; Karley, 2003). The mortgagors gradually introduced the concept of the 5Cs due to previous experiences of failed or delinquent actions of the mortgagees who were unable to meet their amortized obligations to the financial institutions. Literature noted these events led to the collection of information from the silos of the 5 inch floppy discs into some central information systems. Apparently, the various arms of the real estate industry collaborativeness led to the innovative creation of the internet kiosks, platforms and networks in 1970s and 1980s (see figure 1 below). This collaboration became the disruptive node for which various financial institutions and real estate brokers used as a benchmark to finding real estate properties, selling, buying and later led to the formation of institutional Real Estate Investment Trust (REIT) that was then conceptualized (Bernstein, 1996).

Figure 1: Info-graph of the internet kiosks

2017 at aluyainstitute.com

Furthermore, the collaboration equally led to the introduction of various real estate boards. These board or executive members of the boards were created in various cities that ultimately metamorphosed into formation of board members and as a consequence resulted in the introduction of the Multiple Listing Service (MLS) before the current Internet of Things (#IoT), Industrial Internet of Things (#IIoT). Then entered the world of big data where actionable real time from the important datasets used for making real estate decisions. In the 21st century, these decisions could be seem in form of flipping and selling of homes, foreclosures or short sales, tax sales, mortgagees auctioning homes in front of city halls and many more ways of selling and buying real estate properties. Due to nature of the current real estate industry, there are consequences for real estate agents or buyers navigating through various planted land mines in the real estate industry and these land mines cannot be underestimated. Because it means a person could create abundance of wealth. Alternatively, a person could also starve to death if he or she steps into any of the land mines. Therefore, understanding the organic and ground up doctrine or the significant meaning of real estate remain the crux of this article in jofdt.com.

Examination of the 1950s to 1960s

In the late 1950s and beginning of the 1960s, financial institutions despite been sanitized, were marred by the arcane and subliminal complexities of lending loans to inner city minorities. Incredulously as it might have seems, financial institutions found it difficult to grant loans to minorities due by commission or omission, or due to some inexplicable intentional acts. According to erudite and witty Dreier (1991), “redlining” (p.22) emerged as the invisible red pen. Financial institutions received deposits from cross-sections of the inner city customers and subsequently refused to finance housing loans to the same customers because they resided within the same localities (bad neighborhoods). Ultimately, the locality was incidentally where the financial mortgage companies and the minority customers abode. Learners were asked to debate extensively whether or not the financial institutions’ underpinning actions makes any common sense during this period. Opprobriously, the financial mortgage institutions’ actions at this period do not make any benign sense, do they? No!

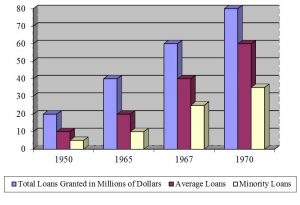

Unrealistically, the financial institutional leaders suggested various reasons for these actions, the reasons for not lending and granting loans to minorities were: (a) there were higher risk involved when lending loans to minorities, (b) the high crime rates in neighborhoods where the banks operated was another primary factor, (c) the lack of an established credit profile by the minorities (5Cs), (d) the disappearances of investments and established businesses due to the lack of investment loans or funding of new and innovative enterprises. Ironically, these actions were confuted without granting loans to customers who deposited funds within the same institutions, the aforementioned scenarios continued to be problematic to economic stability of the communities in questioned. Actions of the financial institutional lenders within this period led to an unprecedented boycott of patronage by the neighborhoods where the banks operated. An ideological eruption emanated from these actions. Systematic campaigns by activists like Mayor Flynn of Boston, Rev. Jesse Jackson, Rainbow Coalition of Communities, Jim Hightower, and Rep. Joseph Kennedy (D-Mass) exposed those financial institutions engaged in redlining. It suffices to say that the confirmed acts committed by the financial institutions led to the fleeing of the middle-income populations from the cities to the suburban areas, such acts were called the “economic flight.” A sclerotic economic measure used to effectively punish the burgeoning middle-class. Using Technological Situational Happenstances (TSHs) and Political, Environmental, Social, Technological, Economic, Legal (PESTEL) were used by an economist from the University of Minnesota, Charles Finn. He was able to prove that lending disparity not only existed between blacks and whites, but the incisive criteria used by financial institutions in funding, rejecting loan applicants, and especially loans for minorities were baseless. Markedly, these actions diminished the amplitude and credibility of institutions’ granting the loans in general. Despite the fact that the ownership of homes and loans approved to applicants increased during this period, minorities were completely disenfranchised from getting loans (see figure 2 depicted below). This narrative will continue in the next publication of the 1970s and 1980s real estate gyrations. Better yet, get the referenced materials used in this work or get an online version of the book here at http://www.jofdt.com/product/leadership-real-estate-and-disruptive-technology-technological-situational-happenstances-2nd-edition/

Figure 2: Epoch of the 1960s

Source: Aluya 2009 at the aluyainstitute.com