Microsoft offered to acquire Yahoo for $40.8 billion. Microsoft attempted acquisition of Yahoo was through hostile takeover or through outright purchase (Asay 2008; Pimental, 2008). According to Pimental (2008), Microsoft has more money than most countries; the company has an excessive cash of over $19 billion. Despite Microsoft huge excessive liquidity, the company was unable to meet its immediate short-term obligation of acquiring Yahoo. Explicitly show maybe, how desperate Microsoft was in trying to acquire Yahoo; the company had sought to use debt to finance this transaction. Microsoft intended to integrate Yahoo into its company’s core philosophy and into its expanded business empire.

Without schism, this case study analysis will not be about Microsoft hodgepodge of businesses but obviously, it is about Yahoo. Palpable kernel to this foreground analysis is what propelled or prompted Microsoft attempted acquisition of Yahoo through hostile takeover. What makes other technology companies envious of Yahoo organizational culture; innovations and sustainable competitiveness through Technological Situational Happenstances (TSHs); Strength, Weaknesses, Opportunities, and Threats (SWOT); Political, Environmental, Social, Technological, Economic, and Legal (PESTEL); are core to this analysis with some verisimilitude? For instance, online advertisement expected to reach an epic proportion of over $80-$120 billion a year by 2010-2017 (Ackerson, 2010; Asay, 2008; Pimental. 2008). Facebook, Google, Yahoo and Twitter, have now surpassed the predictable benchmark of $80 billion of online advertisement (Aluya, 2010). Yahoo innovative technology using TSHs, SWOT, and PESTEL places the company at a sustainable competitive and comparable advantage. Economically and strategically, Yahoo was positioned serendipitously to maximizing profit through online advertisement. Not surprising therefore, that Microsoft wanted to acquire Yahoo. This sanguine discussion starts with the background of Yahoo and the analysis of the remarkable feat accomplished by the company will follow.

Background

In 1994, David Filo and Jerry Yang, doctoral students at Stanford University, founded yahoo. Jerry and David started Yahoo as hobby while working on their doctoral dissertation at Harvard Business School. Understanding the power of internet through the use of TSH, the founders ascended to fragmenting informational materials into categories. The reason why the founders decided to fragment or breakdown information was due to the clustering, clogging and complexities and difficulties involved in finding information within then popularized internet in the 1990s (Donegan, 2000). From initial exotic to ubiquitous, the United States government in the early 1990s fully released the internet for commercial use during this period. Finding information on the ever-expanding World Wide Web was increasingly complex and difficult. Search processes required tedious and time-consuming on the part of the end users. Exigencies of the circumstances led Yahoo founders to categorize information into categories using creative destruction, vis-à-vis disruptive situational technological happenstances. When categories became too full, subcategories were developed, and more subcategories followed. Aptly, the founder’s concept of creating more subcategories in the internet cascaded into the conceptualized framework of what has become known as Yahoo. Yahoo conceptualized from proposal to fruition using the creativity of this novel idea of subcategories (Eisenhardt and Sull, 2001). Exquisitely using TSHs, SWOT, and PESTEL, Yahoo became the First Prima Donna in this ideological eruption of subcategories (Aluya and Garraway, 2014).

Yahoo is a major top internet portal (Donegan, 2000). Yahoo generates an astounding numbers of subscribers on a daily basis with over 100 million visitors. Yahoo systematically uses TSHs, SWOT and PESTEL to reposition the company strategically into the followings (a) obtain exclusive content as a way of creating customer loyalty, (b) establish product bundling packages similar to Microsoft Word, PowerPoint, EXCEL, with e-mail accounts, instant messaging, calendaring, and hosting services, and (c) create additional revenue streams. Yahoo was regarded as one of the major viable competitor in the digital era. Currently, Yahoo burgeoning sales and growth has exceeded 200% market capitalization. Comparably, Yahoo intangibles, intrinsic and sales have exceeded the sales of Walt Disney Company (Eisenhardt and Sull, 2001).

Magnificently, Yahoo was a leading search engine site during the late 1990s. In the late 1990s, according to Nielsen/Net Ratings, Yahoo trailed behind Google in the United Kingdom, Australia, and Germany as the proverbial search engine of choice for internet users. With TSH, subscribers and visitors now frequently use Yahoo search engine due to innovations, inventions, and subcategories search methodologies. For instance, rather than use complex software based algorithmic search solutions that were initially used by competitor Excite, Yahoo uses human web-surfers to read, assess and categorize website characteristics (Rindova and Kotha, 2001).

Rationally expected, the students-turned-entrepreneurs who invented Yahoo attracted lore venture capitalists. With accessible venture capital funding, Filo and Yang were former board of directors and the chief executive officers. The founders understanding their handicap and inexperience in managing an organization hired experts to managed Yahoo. Unlike Facebook initial public offering, Yahoo stock skyrocketed to high price level from the opening price. Yahoo current CEO is Marissa Mayer who took over the helms of affair from former CEO Scott Thomas and iCEO Ross Levinsohn (Swisher, 2013).

Nusca (2010) purported that former CEO, Carol Bartz, stated,

“Yahoo is a great company that is very, very strong in content for its users, uses amazing technology to serve up what increasingly we think is going to be the web of one. People come to us to figure out what’s going on in the world…it’s a place where you can just get it together” (Nusca, 2010, p.1).

To be simplistic, leaders in Yahoo have transcended the company from a simple business model through the use of TSH into a major internet portal.

Strauss, EL-Ansary and Frost (2003) defined a portal as a point of entry to the internet that provides many services in addition to search capabilities. The internet business portals were innovations that started from situational technological happenstances of the internet. Portals were categorized as horizontal or vertical (Donegan, 2000). Horizontal portals were referred as consumer portals, public portals or web portals that were generic organizers for information. In contrast, vertical portals were referred as the corporate portals, enterprise information portals or specialized portals that provide information for groups or for particular organizational specific interests (Spitzer, 2000).

Innovative portal companies increased stickiness. Rosen (2002) purported that stickiness is the capability of the internet portals to keep visitors at the site for as long as possible and thus persuading them to return. Stickiness is also achievable through an encouraging elixir of continuous innovative products and services through local, national, international and global content changes. Stickiness includes using TSHs, SWOT, and PESTEL to offer customized services to customers and increased investment in branding.

With TSHs, SWOT, and PESTEL, Yahoo uses product bundling to maximize profit (Shapiro and Varian, 1999). Yahoo basic informational materials were bundled with services like homepage customization, e-mail accounts, calendaring, instant messaging and hosting services. With TSHs, SWOT, and PESTEL Yahoo provides other services free, although the services bundled up in comparable services (Cooper and Schindler, 2003).

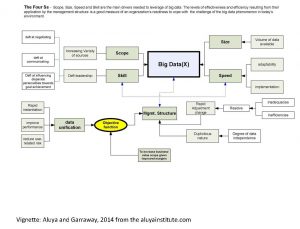

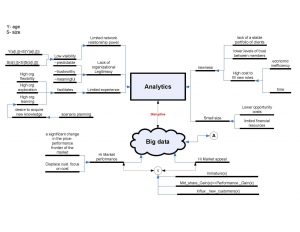

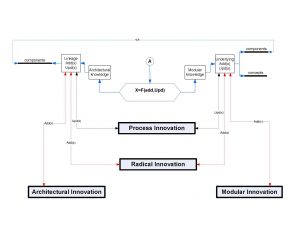

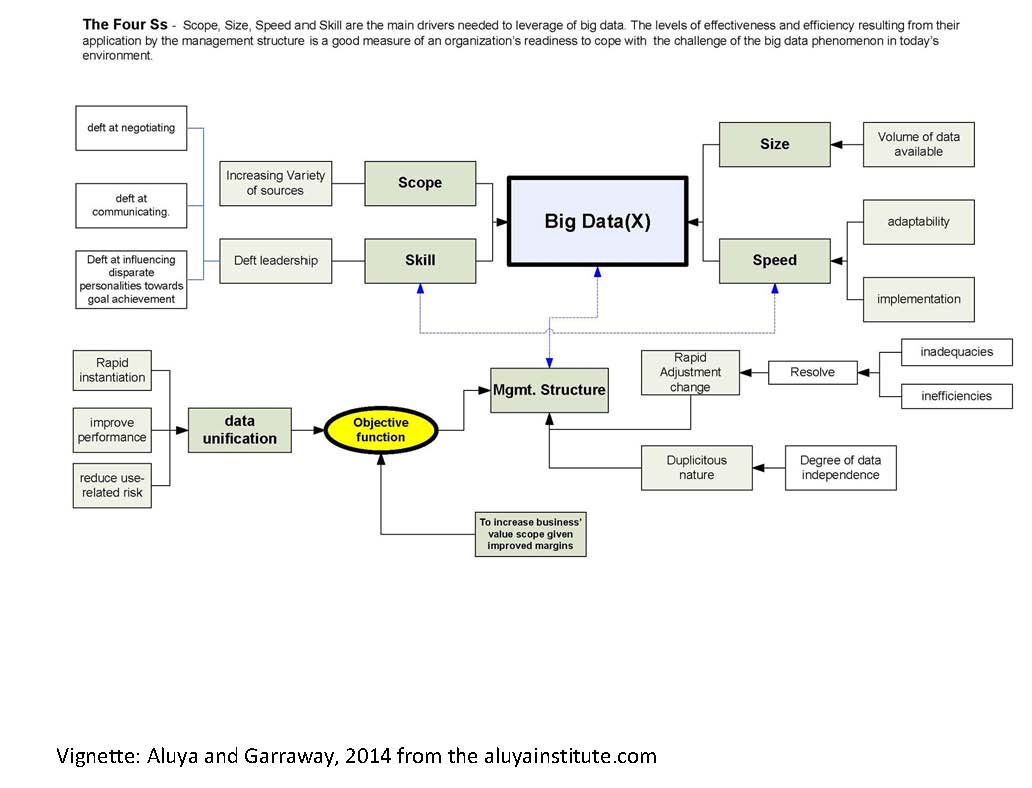

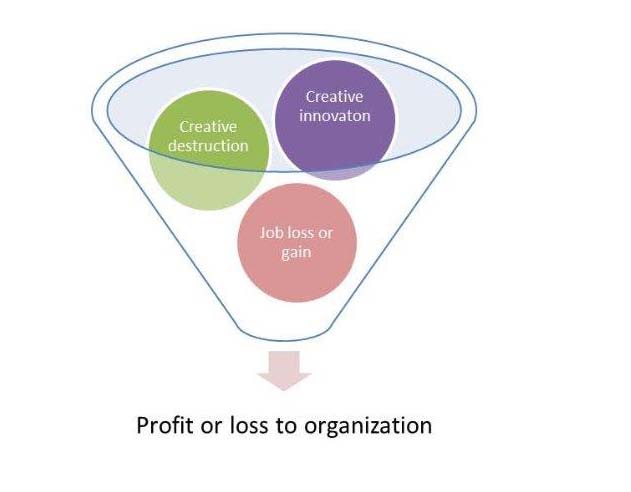

Yahoo’s strategic transition to portal technologies was due to situational technological happenstances using real time data from large data sets (see the figures below) in response to common competitive business pressures. These pressures required constant product innovation, increased revenues through advertising and premium content downloads. Yahoo accomplished this transition through a series of strategic partnerships.

Figure 1: The leveraging properties of big data

This case study includes the following:

- Purpose of the study

- Significance of the study to leadership

- Anticipating global economy recession and recovery periods

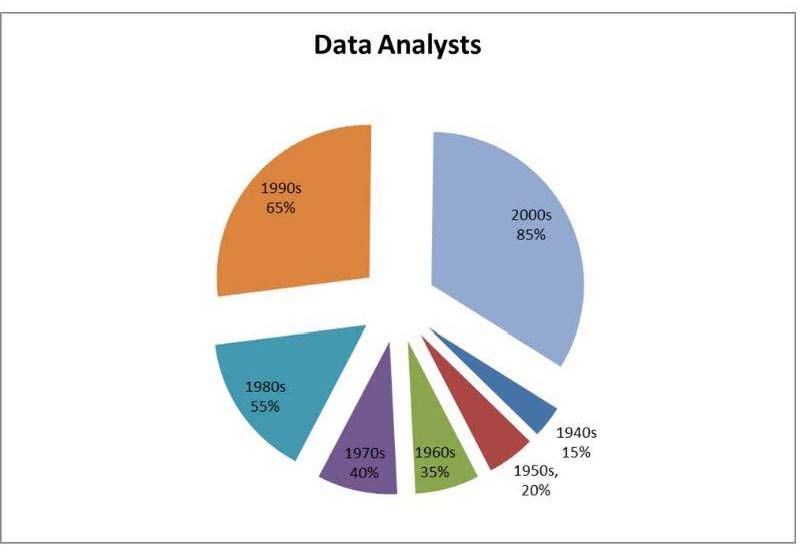

- Financial graphs, charts and vignettes

- Summary and references

Get a copy of this study here at http://www.jofdt.com/product/a-case-study-of-yahoo/